do nonprofits pay taxes on interest income

These non-profits collect revenues that exceed their annual expenses which goes to. Form 990-EZ which is a much shorter version of the main form is for nonprofits with gross receipts between 50000 and 200000.

Infographic What Is A Nonprofit By Cullinane Law For Any Assistance Related To Legal Aspect Of Nonp Nonprofit Startup Start A Non Profit Nonprofit Marketing

For example if a nonprofit purchased 10000 worth of 10.

. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Learn More. The nonprofit must recognize taxable income in the proportion that the property is financed.

Answer 1 of 6. Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. To be exempt from federal income tax the organization in addition to being non-profit has to meet a.

That said youll want to check your local rules in case they differ from federal ones. Additionally nonprofits and churches are exempt from paying all property taxes. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act.

Both charities and nonprofit organizations do not have to pay income tax. Tax-exempt nonprofits are 501c3 organizations. What qualifies a nonprofit for tax exemption.

20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. For the most part nonprofits are exempt from most individual and corporate taxes. Any income from related business activities or those that help sustain a nonprofits primary mission is.

Do charity employees pay income tax. However this corporate status does not automatically grant exemption from federal income tax. Anything more will require the nonprofit to pay both state and federal corporate income taxes.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Answer 1 of 3. This form is due on the 15th day of the 5th month following the end of the Non-Profits fiscal year.

The full Form 990 is for non-profit organizations with gross receipts greater than or equal to 200000. Even though the federal government awards federal tax-exempt status a state can require additional documentation to. In the United States a nonprofit business generally is allowed to earn interest on a checking account and some banks even offer interest-paying checking accounts specifically for nonprofits.

To be tax exempt you must qualify in the eyes of the IRS. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to.

And it doesnt stop there. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you have to file an.

If it ends with the calendar year then the Form must be filed by May 15th. 5 A nonprofit can jeopardize its exempt status by earning too much income that is unrelated to its mission. Then theres Form 990-N commonly known as an electronic postcard which is for nonprofits with gross.

As long as a 501 c 3 corporation maintains its eligibility as a tax-exempt organization it will not have to pay tax on any profits. Interest checking for businesses was limited in general by a Federal Reserve rule called Regulation Q though this was essentially. This guide is for you if you represent an organization that is.

NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. Although 501 c organizations are generally exempt from federal and state taxes some income may be subject to a special tax called the UBIT unrelated business income tax. For tax years beginning after Dec.

The previous answer related to non-profit charities. This tax must be reported on Form 990-PF Return of. There are some instances when nonprofits and churches are still required to pay taxes.

Generally the first 1000 of unrelated income is not taxed but the remainder is. The research to determine whether or not sales tax is due lies with the nonprofit. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. While a qualified Non-Profit does not have to pay any taxes it still must file a Form 990 with the IRS every year. If a NFP fails to file this form three years in a.

Taxes Nonprofits DONT Pay. A large percentage of 501 c 3 nonprofits are also exempt from. 20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate.

There are many examples of this the auto club is one. Nonprofits May Have to Pay Taxes on Certain Activities. But clearly defining what.

However if you are an employee of a nonprofit organization you must pay Social Security taxes on your earnings of 10828 or more. If an employee earns above a certain threshold the charity as an employer must deduct income tax and NICs from the employees pay for each pay period and pay employers. I will answer with respect to non-profit corporations.

For tax years beginning on or before Dec. Entities organized under Section 501 c 3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which includes income and capital gains tax on stock dividends and gains on. There are clear rules as well as several exceptions to.

Updated on May 28 2020. Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. The Social Security tax rate for employers in 2015 was 62 percent on income up to 118500 and the Medicare tax rate of 145 percent of all income levels.

First and foremost they arent required to pay federal income taxes. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of determination to the states Department of Revenue. In a nutshell nonprofits can make up to 1000 of unrelated income before they have to pay taxes on it.

An example of a non-profit corporation may be an HOA or a condominium corporation. There are many terms and conditions that come with gaining 501c3 status. In the USA an organization can be non-profit without being exempt from federal income tax.

Non Profit Budget Template Lovely Loc Thai Cpa Pc Nonprofit Organization Fiscal Year Budget Template Budget Organization Nonprofit Startup

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

How To Get Tax Exempt Status For A Non Profit Organization Accountableph

Chefspasstwelin Non Profit Budget Template Budget Template Budget Organization Nonprofit Startup

Benefits Of Bookkeeping Bookkeeping Accounting Benefit

Nonprofit Law In Germany Council On Foundations

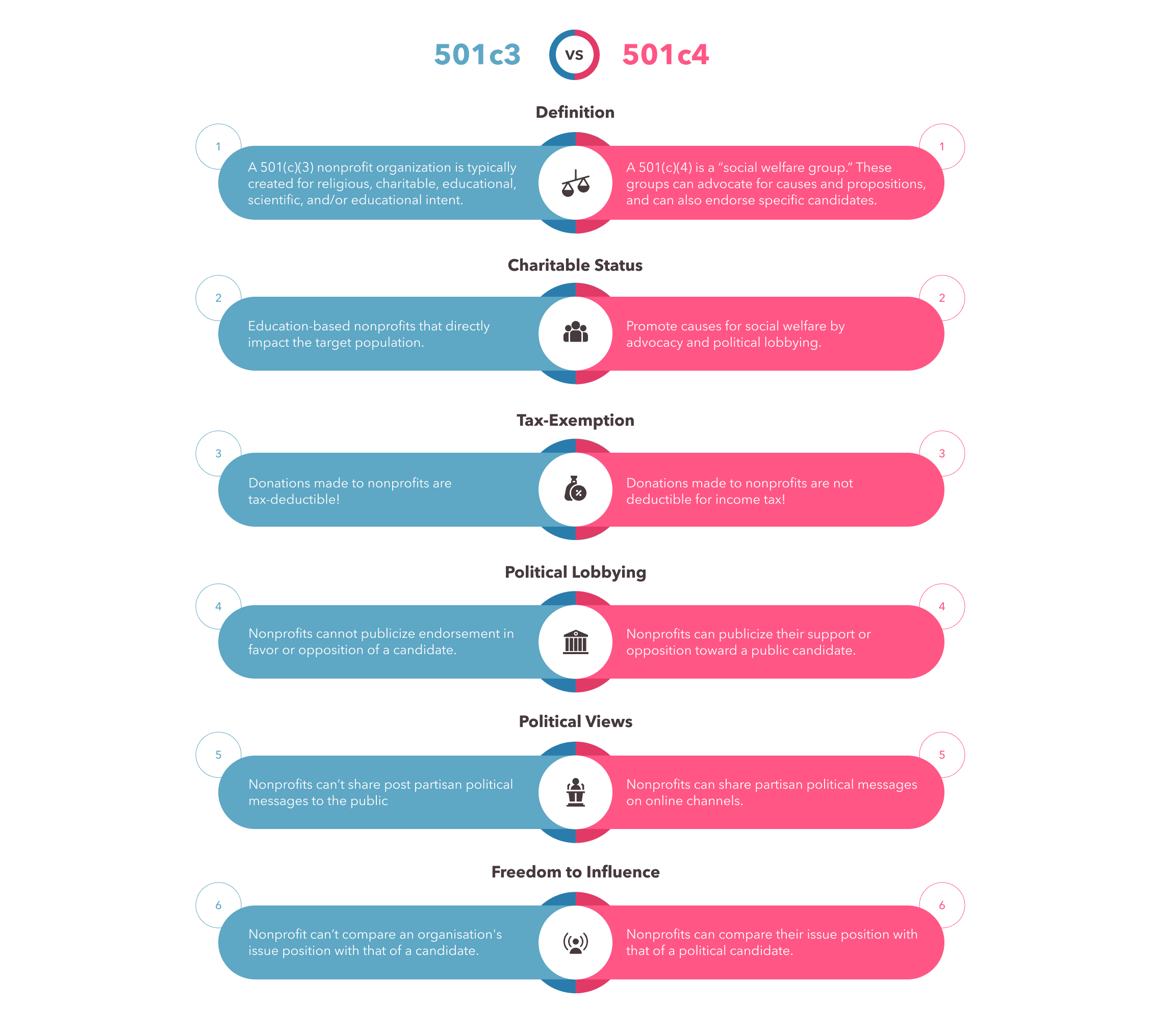

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

What Are The Nonprofit 1099 Rules Moneyminder Non Profit Filing Taxes Federal Income Tax

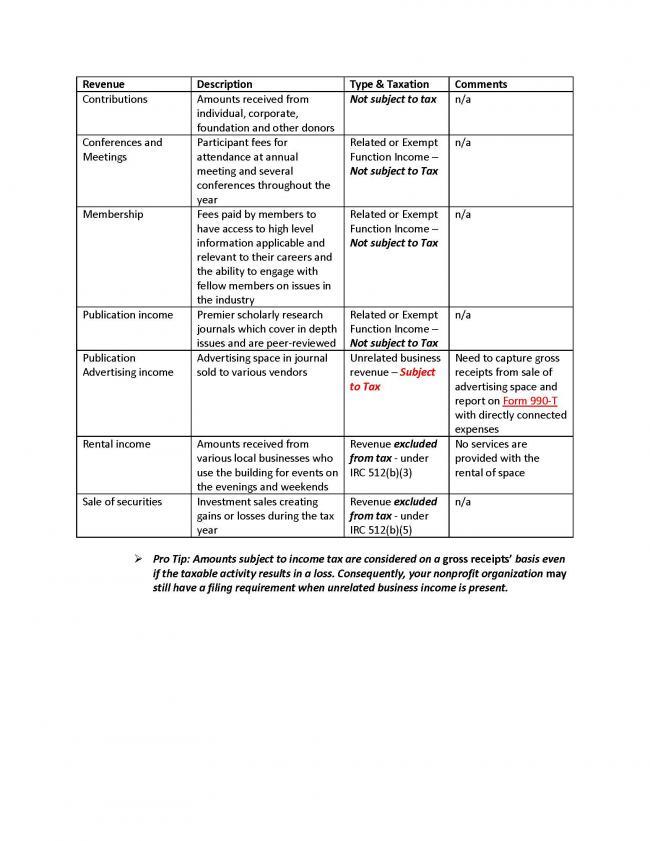

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

New Annual Budget Templates Xlstemplate Xlssample Xls Xlsdata Check More At Https Whitemelon Co Annual Budge Budget Template Budgeting Budget Spreadsheet

Tax Deduction Rules For Nonprofit Organizations Download Table

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Dental Insurance

Donations And Grants In Germany

Pdf Taxation Of Non Profit Associations In An International Comparison

Non Profit Budget Budget Template Donation Letter Template Budgeting

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)